The Sensex (Sensitive Index) is the benchmark index of the Bombay Stock Exchange (BSE) and represents the performance of the top 30 companies listed on the exchange. It is one of the most closely watched indices in India and serves as a barometer of the country’s economic health and investor sentiment.

The Beginning of Sensex

Sensex was introduced on January 1, 1986, by the Bombay Stock Exchange. It was developed to provide a structured representation of the Indian stock market, which was rapidly evolving. The index was originally calculated based on the market capitalization-weighted method, but later, in 2003, it shifted to the free-float market capitalization method to ensure more accuracy in tracking the market.

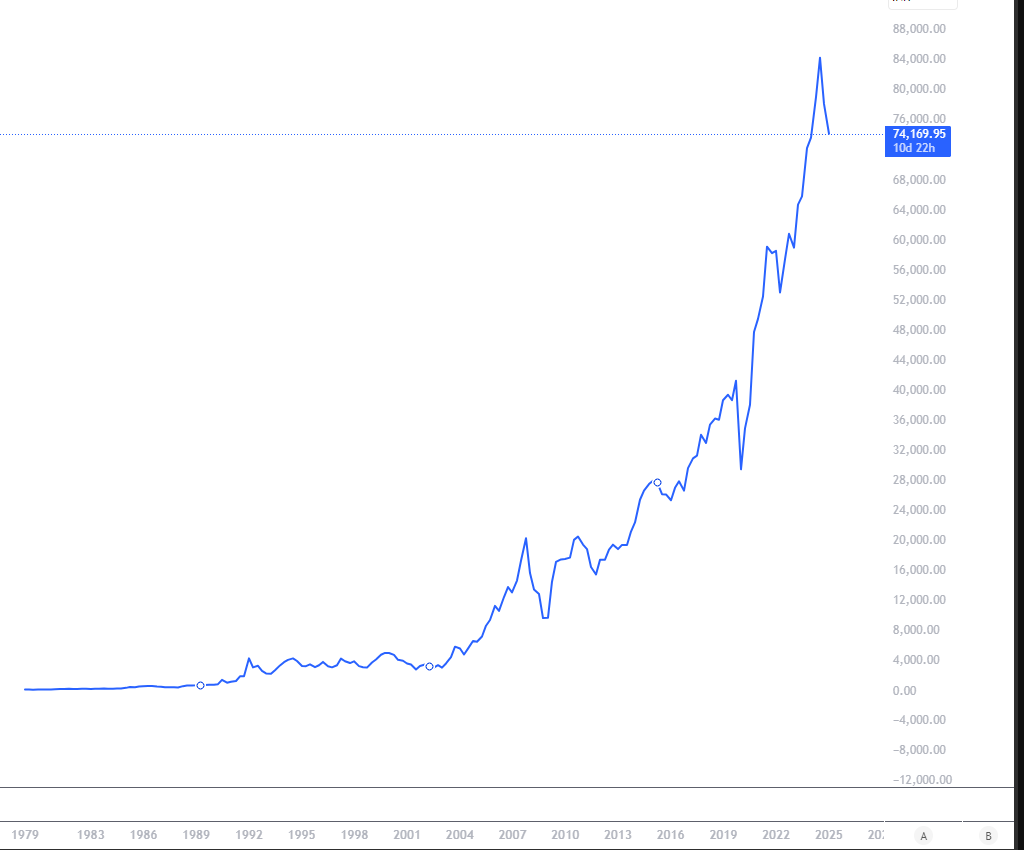

At its inception, the base year of Sensex was set to 1978-79 with a base value of 100. Over the decades, Sensex has witnessed remarkable growth, reflecting India’s economic expansion and globalization.

Major Falls in Sensex History

Despite its long-term upward trajectory, Sensex has experienced several major crashes due to various economic and global factors. Here are some of the most notable falls:

1. Harshad Mehta Scam (1992)

- Fall: Sensex plunged by over 50% between April 1992 and December 1992.

- Reason: The market manipulation by Harshad Mehta, also known as the Big Bull, led to an artificial stock price surge, followed by a crash when the scam was exposed.

2. Dot-Com Bubble Burst (2000)

- Fall: Sensex lost about 32% from its peak.

- Reason: The global burst of the dot-com bubble led to heavy losses in technology and IT stocks, affecting investor sentiment in India.

3. Global Financial Crisis (2008)

- Fall: Sensex crashed by over 60%, dropping from 21,000 in January 2008 to around 8,000 in October 2008.

- Reason: The U.S. subprime mortgage crisis triggered a global economic recession, impacting financial institutions worldwide.

4. COVID-19 Crash (March 2020)

- Fall: Sensex saw one of its fastest declines, losing nearly 38% within weeks.

- Reason: The global lockdowns due to the COVID-19 pandemic caused panic selling across markets.

5. Adani Group Rout (2023)

- Fall: Sensex witnessed a sharp decline of over 2,000 points in response to allegations made in the Hindenburg Research report.

- Reason: Concerns over corporate governance in one of India’s largest conglomerates led to a massive sell-off in Adani Group stocks, affecting overall market sentiment.

Interesting Facts About Sensex

- Fastest 1,000-Point Gain: Sensex crossed 61,000 to 62,000 in just 8 trading sessions in 2021, marking its fastest-ever rally.

- Biggest One-Day Gain: On May 18, 2009, Sensex surged by 2,111 points (17.3%) after election results signaled political stability.

- First 10,000 Mark: Sensex crossed the 10,000 mark for the first time in February 2006, reflecting strong economic growth.

- First 50,000 Mark: Sensex touched 50,000 points in January 2021, driven by post-COVID recovery optimism.

- Longest Bull Run: Between 2003 and 2008, Sensex surged from 3,000 to over 21,000, fueled by economic liberalization and foreign investments.

Conclusion

The Sensex has been a true reflection of India’s economic journey, witnessing both euphoric bull runs and devastating crashes. It continues to be a vital indicator for investors, policymakers, and analysts. Understanding its history, trends, and major events can help traders and investors make informed decisions while navigating the stock market.

Stay tuned for more insights on market trends, trading strategies, and economic developments!

Add a Comment