The Power of Risk Management in Trading

Overview

This case study highlights the importance of risk management, discipline, and mindset in trading. While many traders chase the next big indicator or strategy, the real edge lies in capital preservation and knowing when to stay out of the market.

The Decision to Go Full Cash

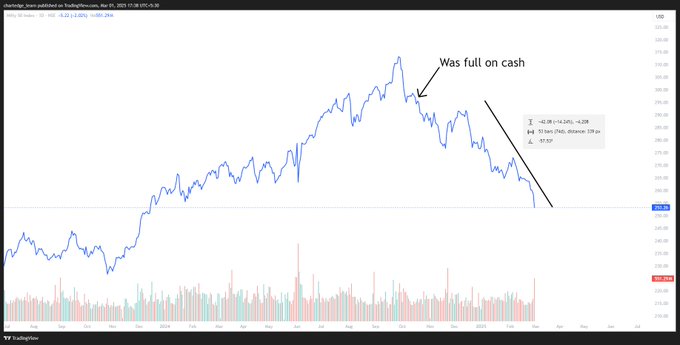

As the chart illustrates, the market was in a strong uptrend before eventually topping out and starting a deep correction. At the right moment, I made the conscious decision to move entirely into cash, avoiding the downturn that followed.

Our trading approach gives the power to be in cash at the right time, ensuring low drawdowns and maximum capital protection. Instead of being stuck in a bad trade, we focus on preserving gains and waiting for high-probability setups.

While many traders remained invested, hoping for a reversal, I chose to protect capital, stay disciplined, and conserve mental energy—an approach that many overlook in pursuit of constant action.

Key Takeaways

✔ Saved Energy & Maintained Discipline – Instead of fighting a losing battle, I conserved my focus for better opportunities.

✔ Kept the Right Mindset – No panic, no stress—just patience.

✔ Protected My Capital – While others saw heavy drawdowns, I stayed safe.

✔ Low Drawdowns, High Confidence – Our trading strategy ensures we’re positioned right, whether in the market or safely in cash.

The Harsh Reality of Trading Education

If I were to offer a class on risk management, barely anyone would show up. But if I promoted a session on indicators and fancy scans, it would be packed, with people happily paying hefty fees.

🚀 Funny how people think! Traders are often drawn to complexity over simplicity, forgetting that risk management is the foundation of long-term success.

Final Thought

The best traders aren’t those who predict every move correctly—they’re the ones who know when to sit out and wait for the right opportunity. This case study is proof that sometimes, doing nothing is the best trade.

By focusing on capital preservation and low drawdowns, we ensure that we’re always ready to strike when the right opportunity comes.